Full form of MICR

MICR stands for Magnetic Ink Character Recognition.

The Magnetic Ink Character Recognition Code is character recognition system which widely used by the banks to identify the originality of the document and to make the process easy and cheque clearance and also other documents. This technology is used with the help of special Ink and characters.

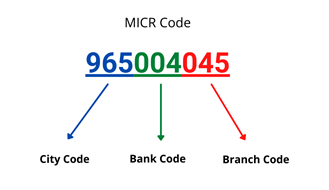

MICR code is printed on the bottom of cheques and it consists of nine digits.

The first three digits indicates for the city code,

The next three codes indicates the bank code and

Last three digits indicate the branch code. Thus, this is called MICR Code.

History

In the earlier days, the process took lots of time in their clearance due to the manual processing of cheques. The numbers of cheques were increasing day by day and so the process became difficult.

The first system was developed by the Stanford Research Institute and General Electric Computer Laboratory to process the cheques using MICR, during the period of mid 1950s.

Working Process of MICR

MICR code available on the document using two types of fonts and which are E-13B and CMC-7, and the ink used in it is magnetic ink.

MICR code passes through the MICR reader and it allows the characters to read easily which covered by the other marks such as, signatures and stamps.

Example

Features of MICR Code

It has small error rate.

Provides high level security for document forge, it is critical to follow the particular Ink.

If MICR fonts do not fulfill the high standard demand, they are rejected.

Even there is some signature or stamp on it, it can read easily.

Other than the normal cartridges, the MICR cartridges are very expensive.

Importance of MICR in Today’s Banking System

MICR (Magnetic Ink Character Recognition) is a critical technology used in today’s banking industry, ensuring the secure and swift processing of financial transactions. MICR full form stands for Magnetic Ink Character Recognition, a method that allows machines to read encoded data on cheques with high speed and accuracy. The full form of MICR is frequently used in banking operations, particularly for verifying critical information such as account numbers and routing details.

By automating the cheque-clearing process, MICR reduces manual intervention, which minimizes errors and enhances the overall efficiency of bank operations. In today’s fast-paced banking system, MICR full form in computer technology is indispensable for ensuring the smooth flow of transactions while reducing the risk of fraud.

Benefits of MICR Technology in Banking

Here are some of the significant benefits of MICR technology in banking:

1. Efficient Cheque Processing & Clearance:

MICR technology is instrumental in cheque processing and clearing. The magnetic ink and specialized font used at the bottom of cheques enable banks to process thousands of cheques quickly. MICR reduces manual errors in cheque handling and speeds up the clearance process.

2. High Accuracy in Data Entry:

One of the key advantages of MICR is its accuracy. Machines equipped with MICR readers can quickly and precisely read data on cheques, such as account and routing numbers. This eliminates the need for manual data entry, reducing errors.

3. Reduced Fraud:

MICR characters are difficult to forge or alter. The magnetic ink used ensures that even if a cheque is damaged or partially illegible, machines can still detect and process the correct information. MICR stands for security and plays a major role in preventing cheque fraud in the banking industry.

4. Compliance with Industry Standards:

Banks are required to comply with industry standards that mandate the use of MICR for cheque processing. This ensures that banking operations run securely and efficiently, meeting regulatory requirements. MICR’s standardization ensures consistent and accurate information across various banking institutions.

5. Minimizing Manual Work:

Automated MICR readers and sorting machines minimize human intervention, speeding up the overall cheque-clearing process. This reduces the workload on bank staff, improves efficiency, and eliminates potential mistakes from manual processing.

Conclusion

MICR technology plays an essential role in modern banking by enhancing the efficiency and accuracy of cheque processing. The MICR full form—Magnetic Ink Character Recognition—illustrates how important this technology is for automating cheque clearing while reducing errors and fraud. With regulatory compliance and minimal manual intervention, MICR continues to be a fundamental part of secure and effective banking systems worldwide.